FinTech Platform Review – How We Exposed fintechplatform.pro Trading Scam

FinTech Platform Regulation and Safety Of Funds

FinTech Platform is a FX fraud that can pose a threat to your investments.

We found one thing in our legal documents that prevented FinTech from being labeled “anonymous.” It was the claim that the broker is located on the Marshal Islands or that it follows Marshall Island laws. Even if it were true, it would not make much difference. It would only mean that FinTech is recognized by the FX industry’s worst jurisdictions. There is no FX regulator in the country. Lawmakers and laws seem to turn a blinder to scammers, even allowing them to base their businesses from remote locations. It’s the ideal place for scammer FX brokers to prosper.

FinTech is not licensed and poses a risk for everyone.

Every day new scam brokers and trading bots appear on the web with only one goal – to steal your money. We have already exposed some of them, for example – Blink Trades, CED Capital Limited, FXrally.

FinTech Platform Trading Assets

The broker provides a web trader that allows us to access Forex currency pairs, stocks and indices, as well as commodities and metals. This is a huge list but it does not mean that users have to immediately start trading with FinTech.

FinTech Platform Leverage

In much the same way as the spreads, all leverages, or at least the values for FX pairs, shares, and crypto share the same value: 1:10. Unlike the spreads, the leverage value here is misunderstood. This means that a FX pair’s leverage ratio of 1:10 is too low while it is very high for cryptocurrency pairs. If you don’t qualify as a professional trader but are willing to take the risk of high-leverage trading, the most viable option is to use the services of an offshore affiliate of an established brand.

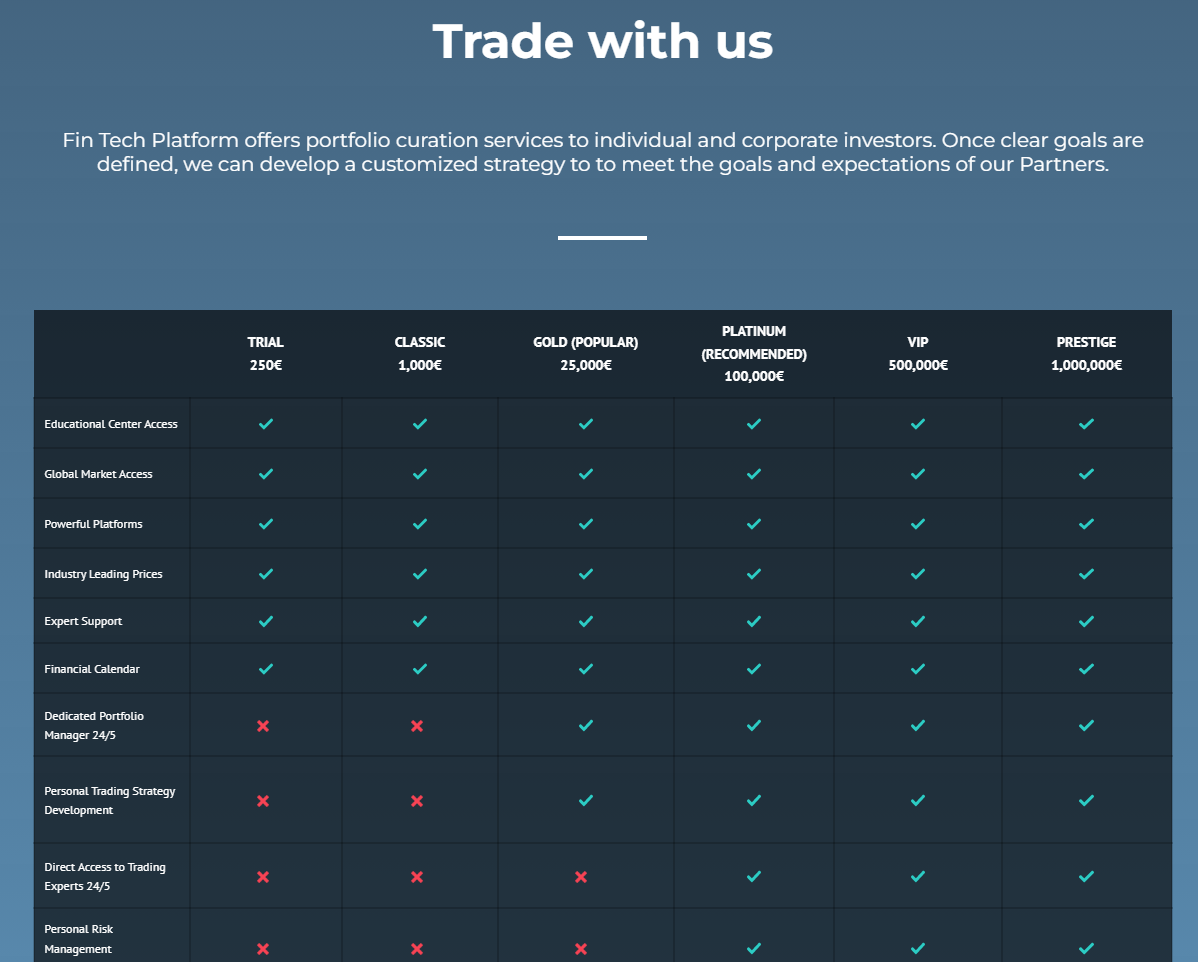

FinTech Platform Deposit, Withdrawal and Accounts

We can find many official payment methods, including credit cards, cryptocurrencies and debit cards, in the user section. The only other news we have for you is that withdrawals are usually processed within 2-5 days, according to the broker.

Choose only trustworthy and reliable brokers. You can read about the best ones in our article Best online brokers in 2023.

The minimum deposit listed in the user area is $250. This is too high an amount for such an unreliable broker.

Chargeback Is Your Solution!

A chargeback is the retroactive cancellation and refund of a charge made using your credit card, wire transfer or some other payment methods.

By putting together a compelling chargeback strategy from beginning to end, victims of online fraud have a relatively high probability of recovering some of all of their funds lost.

However, using a trustworthy service such as MyChargeBack is critical in this endeavour as a typical chargeback process can often be complex and drawn out without the right guidance.

Request a free consultation today by clicking the button below!

FinTech Platform: Video

You can also write a comment under the video on our YouTube channel to tell other traders about your experience. But if you’ve already been a victim, contact us for a free consultation by filling out the form at the top of the page.

Below you will find a short video about FinTech Platform. Watch it so you don’t miss anything important. In a few minutes you’ll learn the whole truth about FinTech Platform!

Related Reviews

FAQ

- Can I Try a Demo Account?

FinTech Platform claims to be able to do this, but we can't confirm it.

- FinTech Platform Maximum Leverage

Up to 1:200

- Is FinTech Platform Safety?

FinTech is not licensed and poses a risk for everyone. Also broker is located in the Marshal Islands where the laws and lawmaker seem to all turn a blind eye to scammer.

- What Trading Platform Does FinTech Platform Provide?

Web Trader

Comments