QCFinances Review – Is qcfinances.com Broker Scamming People?

|

|

Unregulated Scam Broker |

|

|

No Regulation (Illegal Broker) |

|

|

qcfinances.com |

|

|

No Info |

|

|

QCFinances Group |

|

|

Switzerland (allegedly) |

|

|

2022 |

|

|

Web Trader |

|

|

$250 |

|

|

Forex / Crypto / Stocks / Commodities / Indices |

|

|

Available – BTC, USDT, ETH… |

|

|

1:500 |

|

|

No |

Is QCFinances a Legitimate Broker?

The trading license is the most crucial aspect of a broker’s legal background. However, the regulation of QCFinances is problematic. There is an anonymous website alleging that this brokerage operates from Switzerland.

To verify this claim, we examined the register of FINMA, the Swiss financial market regulator, but found no record of QCFinances Group. The absence of this entity in FINMA’s database indicates that QCFinances is not authorized to conduct operations in Switzerland.

It is important to note that Switzerland falls within the jurisdiction of the European Securities and Markets Authority (ESMA) as part of the EEA zone. Therefore, FINMA operates under ESMA’s regulatory framework. QCFinances clearly does not comply with ESMA’s rules and regulations. As an example, European brokers are restricted to a leverage cap of 1:30 for retail clients, whereas QCFinances offers leverage of up to 1:500.

In our search, we also checked the registers of other reputable European regulators but found no evidence of QCFinances. Interestingly, QCFinances openly declares that it is not regulated by the UK’s Financial Conduct Authority (FCA).

To summarize, QCFinances is an anonymous website engaged in fraudulent trading practices. It is imperative to avoid this platform.

Every day new scam brokers and trading bots appear on the web with only one goal – to steal your money. We have already exposed some of them, for example – Nextonbid, AKO Markets, Tolentino.

QCFinances – Traders’ Reviews

Based on a complaint we came across, it is evident that QCFinances is undoubtedly a fraudulent brokerage. The complaint described in detail how this unfortunate individual fell victim to the scam.

Withdrawal problems are a typical red flag in trading scams, and it appears that QCFinances exhibits this behavior. In addition, the cessation of communication and the imposition of unauthorized fees further confirm that QCFinances is engaged in unethical practices. Therefore, it is strongly advised to avoid scammers like QCFinances.

… I invested $10K in July this year. It grew to $27K recently. Heavy pressure to add more dollars. I refused. Then I tried to withdraw. That was the trigger to stop all communication. Ii have sent numerous requests but no reply.

– PersonalReviews user, December 29, 2022.

Choose only trustworthy and reliable brokers. You can read about the best ones in our article Best online brokers in 2023.

QCFinances Trading Assets

QCFinances provides the following options when it comes to trading instruments:

- Forex currency pairs: EUR/USD, GBP/USD, AUD/CAD…

- Indices: NASDAQ100, S&P500, NIKKEI225…

- Stocks: Eni, Adidas, Bayer, Google, Apple…

- Commodities: gold, crude oil, wheat…

- Crypto: BTC, ETH, LTC…

QCFinances’ Account Types

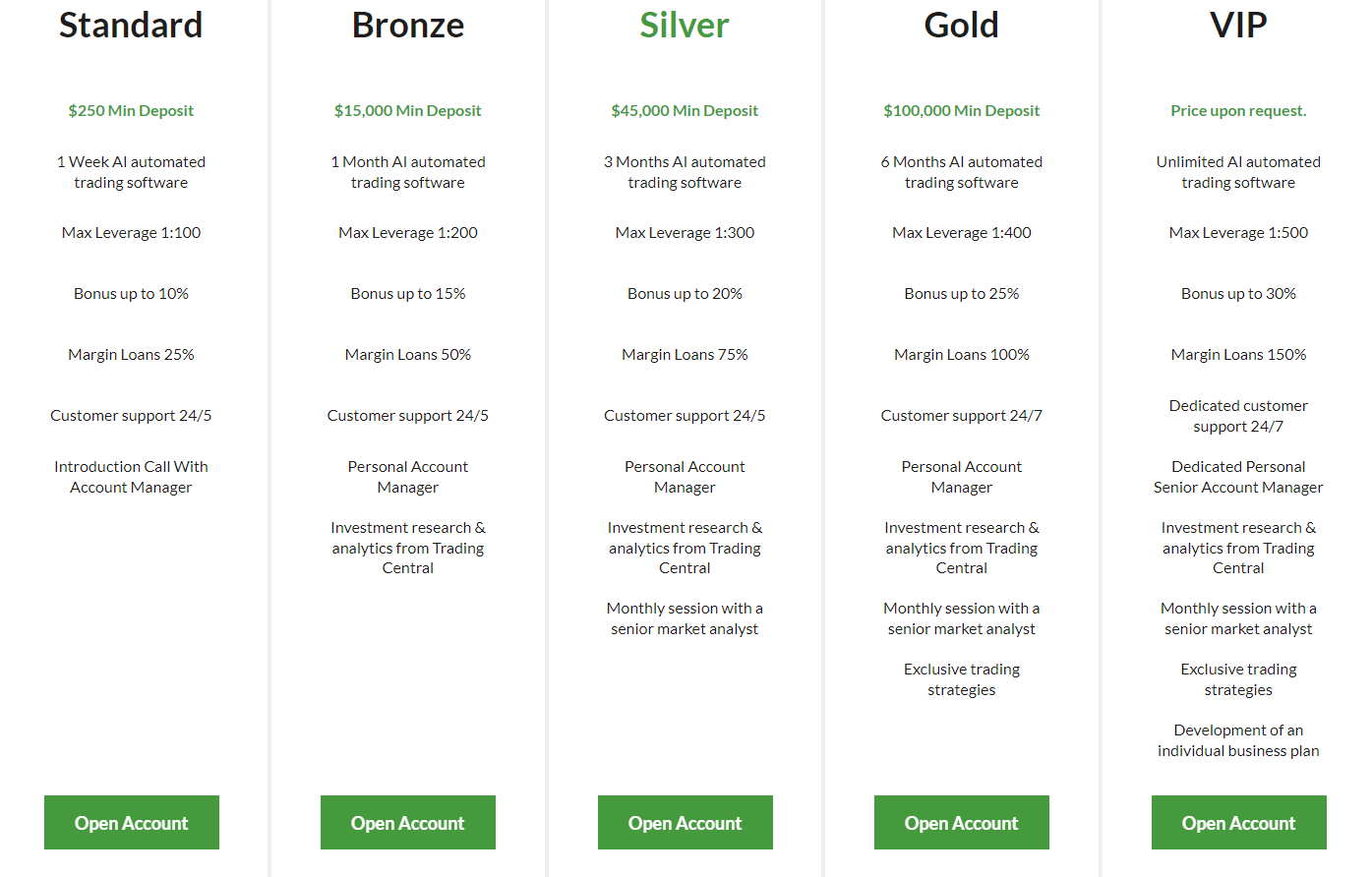

QCFinances offers five different trading account types:

- Standard: 250 $;

- Bronze: 15,000 $;

- Silver: 45,000 $;

- Gold: 100,000 $;

- VIP: unlimited.

QCFinances utilizes a tiered account structure, where the maximum leverage increases as customers move up the account tiers. Consequently, QCFinances offers an extremely high leverage of up to 1:500. As mentioned earlier, ESMA’s regulations restrict the leverage offered by brokers in the EEA zone to 1:30 for retail clients.

The introduction of a leverage cap aims to protect traders from substantial losses, as excessively high leverage often leads to unfavorable outcomes and can be considered a risky gamble.

In addition, QCFinances entices clients by providing bonuses associated with each account type. However, it is important to note that ESMA has prohibited the offering of bonuses, rendering these enticing “awards” illegitimate and in violation of regulations.

Chargeback Is Your Solution!

A chargeback is the retroactive cancellation and refund of a charge made using your credit card, wire transfer or some other payment methods.

By putting together a compelling chargeback strategy from beginning to end, victims of online fraud have a relatively high probability of recovering some of all of their funds lost.

However, using a trustworthy service such as MyChargeBack is critical in this endeavour as a typical chargeback process can often be complex and drawn out without the right guidance.

Request a free consultation today by clicking the button below!

What Should I Do If I Am Scammed by QCFinances?

There is not much that you can do to stop these scams on your own. We encourage our readers to get in touch with our staff. The more evidence we have, the quicker we can try return your money.

Contact our team if you or someone you know is a victim. Online chat is the fastest way to get a response and receive a free consultation. Do not give up! The sooner we act, your chances of recovering your money are better!

QCFinances: Video

You can also write a comment under the video on our YouTube channel to tell other traders about your experience. But if you’ve already been a victim, contact us for a free consultation by filling out the form at the top of the page.

Below you will find a short video about QCFinances. Watch it so you don’t miss anything important. In a few minutes you’ll learn the whole truth about QCFinances!

Related Reviews

FAQ

- What is the Minimum Deposit at QCFinances?

250$

- Is QCFinances a Legitimate Broker?

QCFinances is an anonymous website operating as a scam. The platform lacks a trading license and regulatory oversight, making it highly unreliable and unsafe for investments. It is strongly advised not to engage with this fraudulent scheme under any circumstances.

- QCFinances Maximum Leverage

1:500

- Can I Try a Demo Account?

QCFinances advertises a purportedly risk-free demo account. However, obtaining access to this demo account requires contacting the broker directly, which raises suspicions about their practices.

Comments