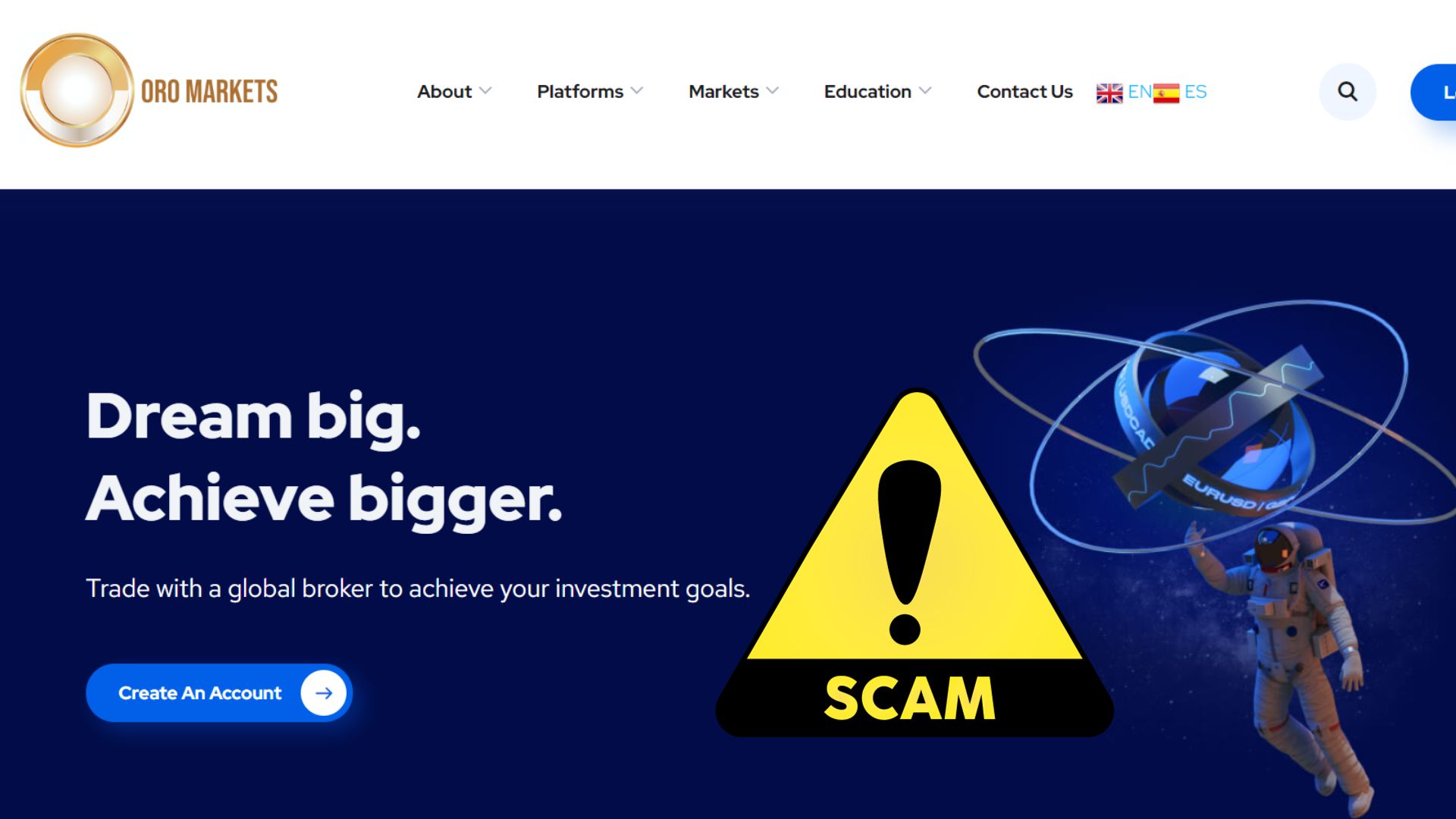

Oro Markets makes audacious assertions that every decision made with them leads to success. They suggest that even individuals with minimal trading experience can profit like seasoned Forex experts, all thanks to their services.

However, when we examine their track record, which includes multiple listings on blacklists and associations with payment facilitators linked to money laundering, Oro Markets falls significantly short of meeting the high expectations they set. Continue reading this Oro Markets review to gain a comprehensive understanding of the extent and scale of this fraudulent enterprise.

Regulatory Warnings Surrounding the Oro Markets Scam

If there were a competition for the number of times a broker has been blacklisted, Oro Markets would certainly be among the leaders. The parent company, ECB7 CAPITAL LTD, supposedly registered in SVG, seems to exist in a shadowy realm, as SVGFSA has no record of it.

The broker’s website also displays a US address, but Oro Markets is not a member of the NFA as a regulated entity. Their website lacks any information about a license, prompting us to investigate further. We uncovered warnings from regulatory authorities such as CNMV, FSMA, CONSOB, and ATVP. Some of these regulators have also blacklisted FX Winning for similar reasons.

Another red flag that strongly discourages investment here is the broker’s association with blacklisted payment services like Mercuryo, Moonpay, and Itez.

Who Falls Victim to This Scheme?

In its brief and regrettable existence of just a few months, this fraudulent broker has cast its net across various countries, including:

- United States

- Philippines

- Canada

- Italy

- Ecuador

Victims are lured in with enticing presentations showcasing fictitious profits supposedly generated through platform data manipulation.

The Unscrupulous Tactics Highly skilled and verbally aggressive scam agents employ relentless persuasion tactics to coax you into investing in seemingly attractive deals that sound great on paper and over the phone. In reality, your investments vanish in the blink of an eye, leaving you financially depleted.

Dubious Trading Conditions on Display

To entice their victims into reckless investments, Oro Markets resorts to a web of deceit. They advertise seemingly favorable trading conditions, such as incredibly low trading costs as low as 0.03 pips.

However, their leverage levels are a glaring example of regulatory violations, with levels soaring to an astonishing 1:500, while Tier 1 regulators typically impose limitations of 1:30 or 1:50. A similar disregard for regulations can be seen with InvesaCapital, another fraudulent operation offering the same high leverage.

Moreover, Oro Markets keeps other fees conveniently concealed. Their legal documents only vaguely mention that any fees or commissions will be deducted directly from the trader’s account balance, yet another breach of regulatory standards.

Conclusion

In conclusion, Oro Markets presents itself as a broker with enticing promises of easy profits for traders of all experience levels. However, a closer look reveals a disturbing pattern of deception and regulatory non-compliance.

This broker has a troubling history of being repeatedly blacklisted by multiple regulatory authorities. Its parent company’s registration in SVG appears to be questionable, and the broker lacks transparency regarding its license status. Furthermore, Oro Markets’ affiliation with blacklisted payment services raises significant concerns about the legitimacy of its operations.

The victims of Oro Markets come from various countries, and they are often enticed by false profit presentations and pressured by skilled scam agents. Tragically, investments made with Oro Markets tend to disappear rapidly, leaving individuals financially devastated.

The broker’s advertised trading conditions, including low trading costs and exceptionally high leverage, violate regulatory standards and demonstrate a disregard for financial regulations. Additionally, the lack of transparency regarding fees and commissions further erodes trust in this broker.

In light of these serious issues and red flags, it is strongly advisable to avoid Oro Markets as an investment option. Instead, investors should seek reputable and regulated brokers that prioritize transparency and compliance with financial regulations to protect their investments and financial well-being.

Comments